We opened up our eldest son's college fund just two weeks ago. Cutting back in groceries has freed up money to help us reach this goal. We have four more kids to open funds for, but at least the oldest has somewhat of a start. In 2009 our budgeted money for groceries was about $350 per month and at times I would spend upwards of $400. (To this day I am still working on staying in budget!) But now that we're spending less money on groceries (which I DO want to increase someday), about $200 to $225, that frees up about $100 to $150 extra a month to put towards goals....like a college fund!

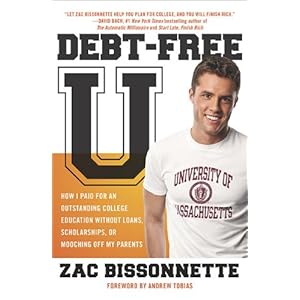

I recently finished this book by Zac Bissonnette. This is my first book I've read about kids and college. My oldest boy is only 7, but after hearing about this book on the Dave Ramsey show I wanted to read it. I am glad I did. I could probably fit all I liked about this book into one, short chapter. But, I would recommend reading the whole thing.

Image from Amazon.com

My husband and I were really blessed and our parents were able to help some financially with our schooling. They didn't pay everything--we definitely had to work--but we were both blessed by their help. We'd like to do the same for our children. Possibly a we'll-pay-tuition-and-books-and-you-pay-housing-and-food type of deal. The old adage Time is Money applies to me right now. I have time on my side and should put it to use and have interest as a partner--not enemy.There were a couple of things I learned in this book that I had never thought of (not too hard for me though!). My favorite was this:

Anyone...who says the current levels of student loan debt won't have a material impact on people's ability to build wealth is full of it...

...How would student loan debt have impacted your financial life? The average graduate will spend about $200 per month on student loan debt for twenty years before she's finally free. Were you rolling in dough to the extent that you could have done that when you were in your twenties and thirties? Given that more than half of Americans don't have enough in savings for retirement, the answer is most likely no. Let's add some numbers to the mix to make this more (or less) fun. Student 1 graduates with the national average in student loan debt. He spends the next twenty years dutifully sending in $200 per month. He does no saving. Student 2 graduates with no student loan debt and spends the next twenty years dutifully saving $200 per month and investing it at 11 percent per year. He does no other saving.

A woman recently e-mailed me to say that she and her husband have a combined $60,000 in student loan debt and refer to it as the little ski lodge in Wisconsin that they'll never actually have.

Wow. I had never though of student loans like that--as being able to reduce my ability to build wealth. If Lee and I had come out of school with no loans, how awesome would it have been to have invested $38,000 right out of school?! We were extremely blessed though, and paid off our loans in one year. And truthfully, I don't know how we would have done school otherwise.

Now we are working hard to have future funds available to our kids when they go to college. This way once kids start college we won't have to use any (or hopefully hardly any) of our income at that future time. And when college rolls around my husband and I can buy a BMW instead of paying college tuition.

So next time I am eating ramen, I just need to remind myself of the future good we're accomplishing.

Image from ednewscolorado.org

~Ramen Queen

No comments:

Post a Comment